Qualified Business Income - Are You Eligible for a 20% Deduction?

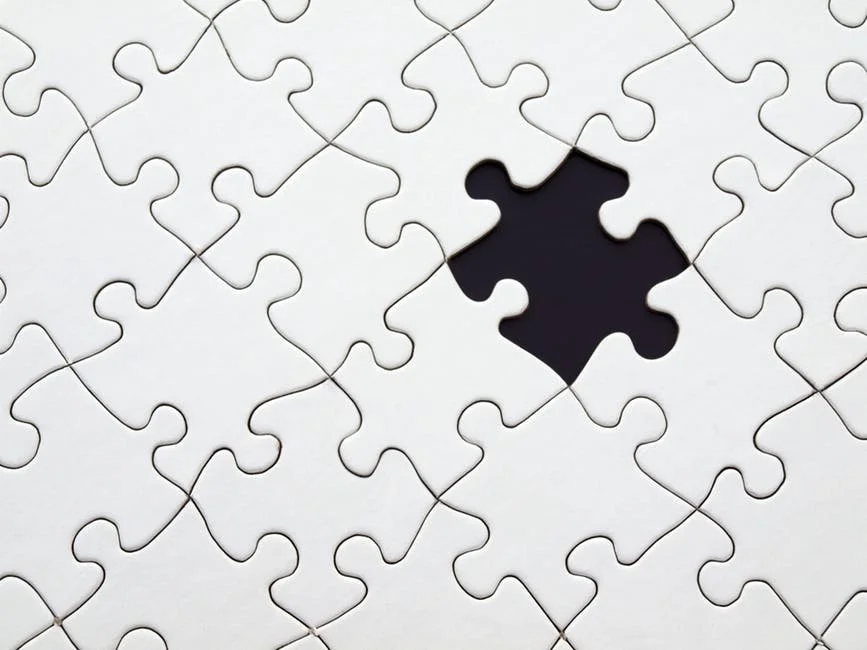

/Have you ever been asked to define the undefinable? At first glance, the new 20% Q.B.I. deduction – a reduced tax rate for the self-employed and partnerships introduced by the Tax Cuts and Jobs Act (“T.C.J.A.”) – seems to be just that: a maze in which the general rule is modified in hidden ways through subdivisions of subsections and in definitions that have substantive effect. In their article, Stanley C. Ruchelman and Fanny Karaman logically guide the reader in detail and with illustrations.

Read More